Recording Advanced Payments for Merchandise

Some clients are offered the opportunity to make an advanced payment to a supplier as a tax deductible benefit at the end of a financial year eg Nutrien, Delta Ag etc. To reflect this payment in CB and you need to:

In the financial year you have made the payment:

In the financial year you have made the payment:

1. Create an Advance Payment chart code if you don't already have one, or would like to specify the supplier

This should also record the GST that you have paid upfront.

Go to the the Chart of Accounts > Expense tab > Click on Add

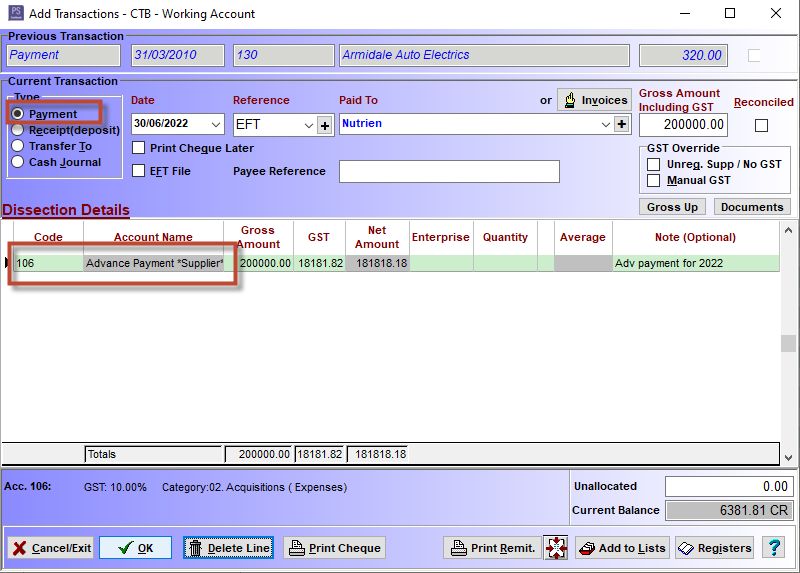

2. Add your transaction or recode the existing one to the newly created chart code:

In the new financial year

1. Create a "Bank" to record the transactions that you make during this new financial year and keep a tally on payments and interest received.

To create the Bank

Go to the Chart of Accounts > Banks tab

Click on Add and complete the code as per the image

Enter an Opening Balance amount LESS the GST.

2. Add an Income account for any interest received on the advanced payment by going to the Income tab.

3. Add the transaction to Cashbook and allocate it to the correct expense account so you can trace the purchases:

All transactions should be GST free if you have paid the GST in the previous financial year.

If you receive interest from the supplier with your advanced payment you can add it as an income:

The balance will be reflected in the Current Balance field at the bottom of the window.

Trial Balances and Cashflows etc will reflect the purchases and running balance when generated.

CBCon KM100