Allowances - Payment Summary?

Allowances - Payment Summary

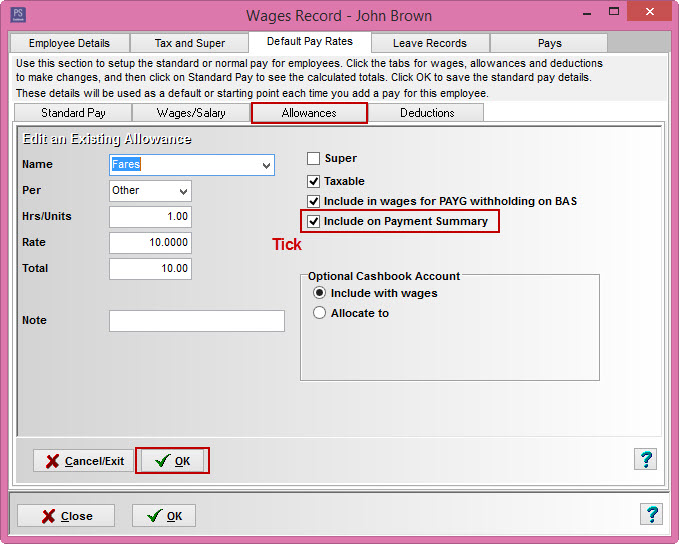

Note: Tax Scales between 61 - 70 are for contractors and not individuals. The flat rate scales in the 61-70 range will need to be changed to something in the 1 - 59 range for the allowance/s to appear on the Payment Summary

To show the allowances on employee's Payment Summary (Group Certificate)

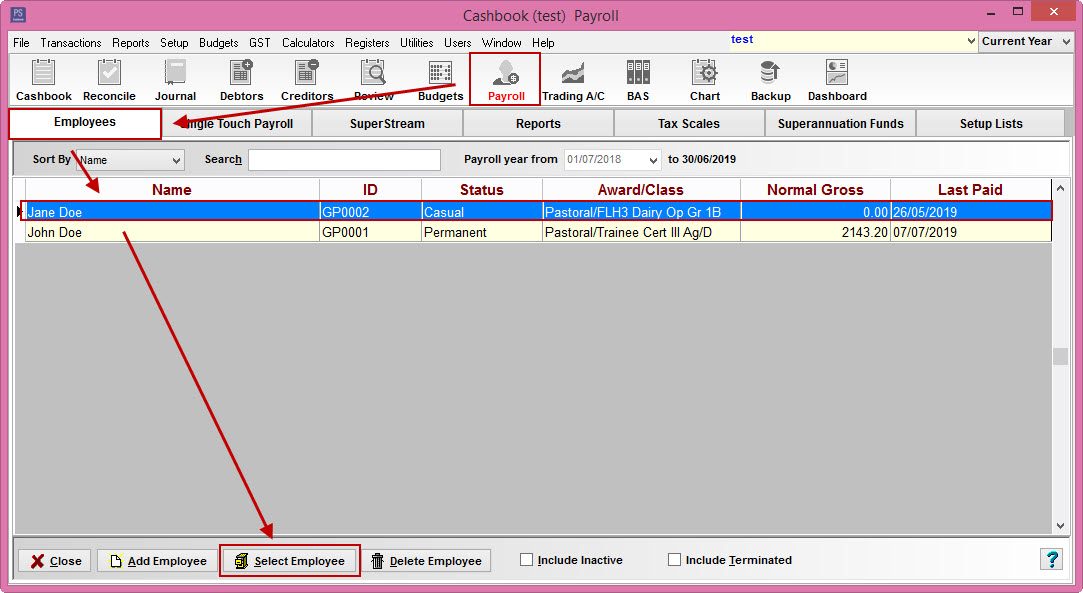

Step 1: Select Employee

- Click the Payroll toolbar icon

- Click the Employees tab

- Click on the required employee to highlight

- Click on the Select Employee button

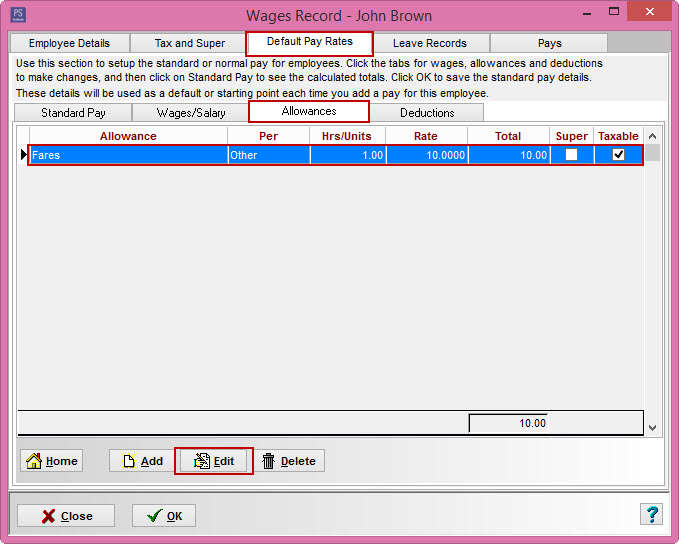

Step 2: Allowances

- Click on the Applicable Pay Rates ( or Default Pay Rates) tab. This will only affect new pays done after this change. To change existing pays, click on the Pays tab instead of the Applicable Pay Rates tab, edit the required pay, select the Allowances tab and modify the required record(s)

- Click on the Allowances tab

- Click on the required allowance (eg. Car Allowance) to highlight and then click Edit, or click Add to add a new default allowance

iv. Tick the Include on Payment Summary check boxv. Click OK

Article ID 1217