Credit from a Supplier.

Credit from a Supplier

Occasionally, you may need to record a credit from a supplier, i.e. a supplier owes you money. For example, if you purchase goods that are damaged, the supplier may refund you the purchase value or apply the amount to other unpaid purchases you have with them.

Note: Debit Note is issued by the purchaser, at the time of returning the goods to the vendor, and the vendor issues a Credit Note to inform that he has received the returned goods.

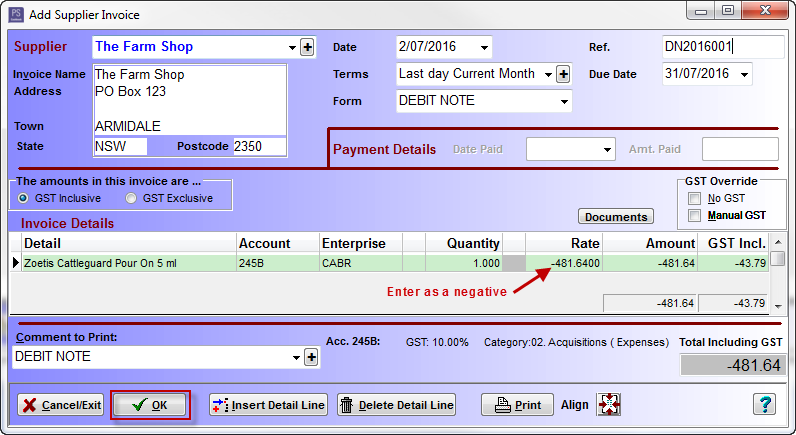

Step 1. To record the debit/refund in Cashbook

-

Click on the Creditors toolbar menu option

-

Click on the Invoice tab

-

Click on the Add button

-

Select the Supplier from the drop down list

-

Date : date of credit note issued by the supplier

-

Form : Debit Note

-

Ref .: this can be the number on the credit note issue by the supplier or a number with some reference to original tax invoice

-

Invoice Details: enter applicable details e.g. product, account, enterprise

-

Enter Amount as a NEGATIVE (-)

-

For Example:

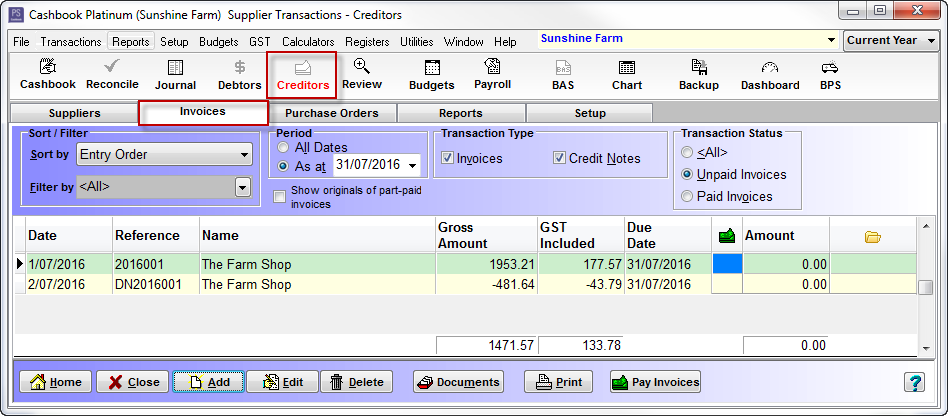

As it appears in invoice list:

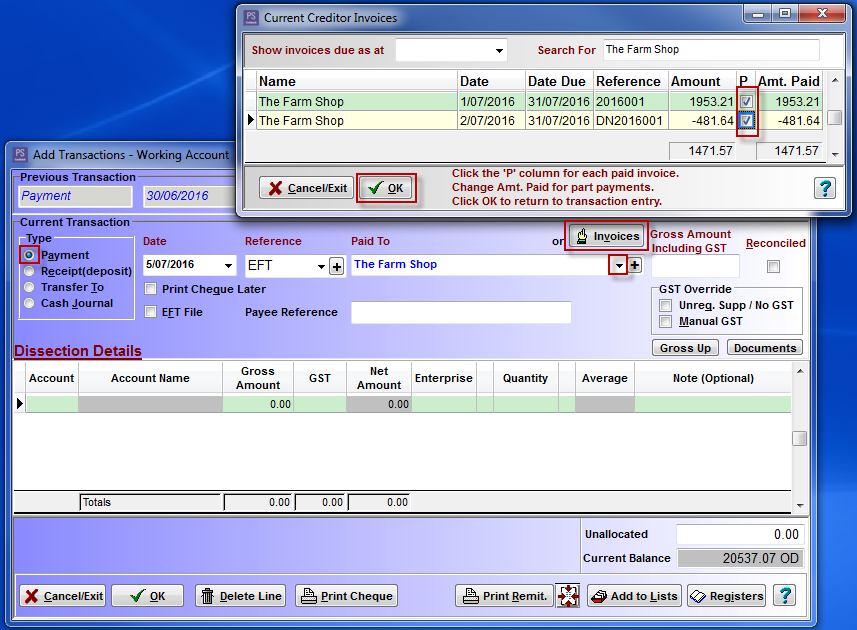

Step 2. Making a payment to supplier including the Debit Note:

-

Click on the Cashbook toolbar option

-

Click on the Add button

-

Type : Payment

-

Date : date paid

-

Reference : e.g. EFT

-

Paid To : select Supplier from the drop down list. e.g. The Farm Shop

-

Click on the Invoice button

-

-

Current Creditor Invoices window will open up

-

Tick the check box next to the invoice/s and debit note you want to include in payment

-

Click on the OK button

-

-

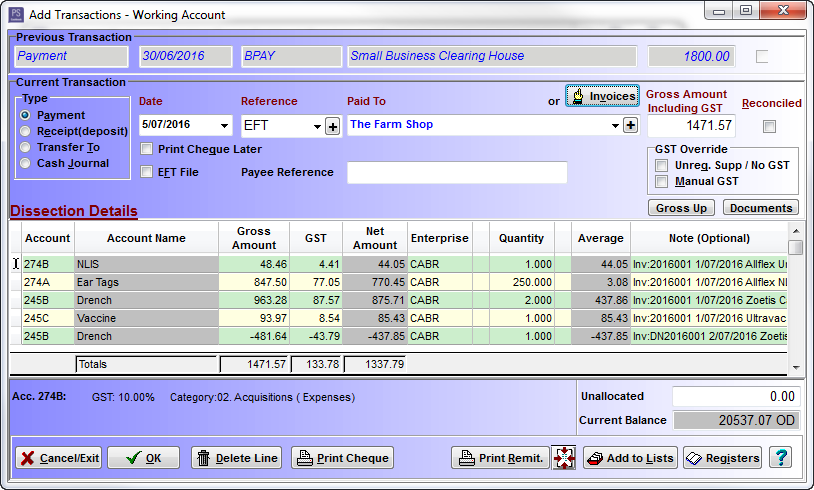

The amount to pay and the dissection details are automatically filled

-

Click OK to save

Article ID 1641