Fuel Tax Credit

Fuel Tax Credit

Cashbook Platinum

Fuel Tax Credits (FTC) provide businesses with a credit for the fuel tax (excise or customs duty) that's included in the price of fuel used in: machinery, plant, equipment and heavy vehicles.

FTC rates are now indexed twice a year - generally on 1 February and 1 August. These changes fall in the middle of a BAS, so Cashbook users will need to contend with 2 rates in some BAS periods.

Practical Systems has devised a simple method for automatically calculating the FTC. It is an easy way to avoid mistakes when working out the fuel tax credit amount to claim on your BAS because it will automatically include the correct rates.

FTC rates are now indexed twice a year - generally on 1 February and 1 August. These changes fall in the middle of a BAS, so Cashbook users will need to contend with 2 rates in some BAS periods.

Practical Systems has devised a simple method for automatically calculating the FTC. It is an easy way to avoid mistakes when working out the fuel tax credit amount to claim on your BAS because it will automatically include the correct rates.

Note: It is possible to still use a 'Manual' method of calculating the FTC if desired.

Note: It is possible to still use a 'Manual' method of calculating the FTC if desired.To Change the FTC Calculation Method to “Automatic"

If needing to claim Fuel Tax Credits in the next BAS, please follow the steps below:

Step 1: BAS

- Click BAS icon on the main toolbar

- Click Fuel Tax Credit tab

- Tick the Include in BAS check box

- Tick the Calculation Type check circle, so it is set to 'Automatic'

- Click Yes to the Confirm message: ' Any manual worksheets you have will be deleted if you switch to Automatic. Do you still want to switch to Automatic?'

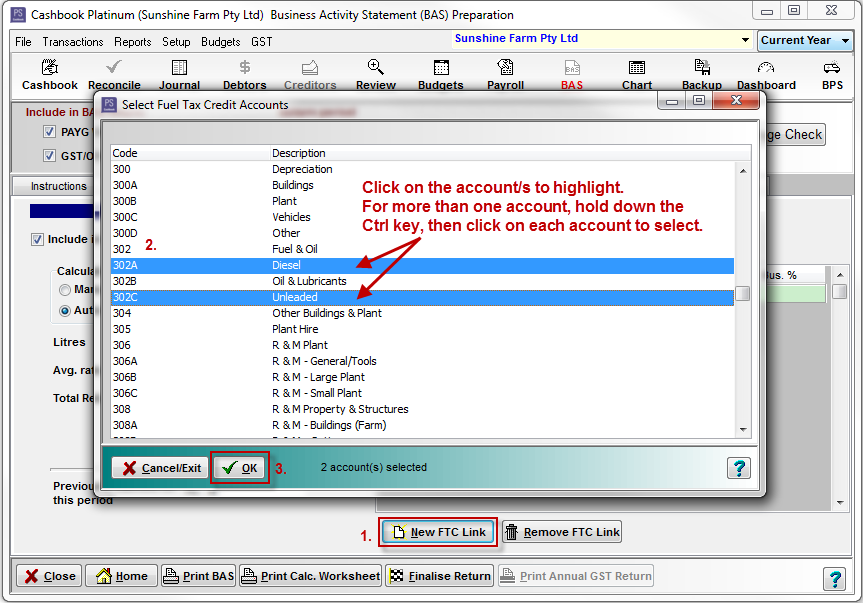

Step 2: New FTC Link

- Click on New FTC Link

- In the Select Fuel Tax Credit Accounts window, select fuel account/s, by clicking on an account to highlight, if more than one account is a fuel-purchase account, click on the first account, hold down the Ctrl key on keypad and left click on the other accounts using the mouse

- Click OK

Step 3: FTC Rebate Type

- Click in the FTC Rebate Typecolumn, next to each fuel account, and select the applicable rebate rate type

If unsure please contact your accountant or check the ATO website

If unsure please contact your accountant or check the ATO website - Repeat this step for each fuel account

Step 4: Bus %

- Click on the Bus. %column, next to each fuel account, and enter the business percentage

If unsure please contact your accountant

If unsure please contact your accountant Business percentage is how much of fuel usage is a work-related expense

Business percentage is how much of fuel usage is a work-related expense - Repeat this step for each fuel account

Step 5: Completed

- The Fuel Tax Credit will now be automatically calculated. The rest of BAS can now be completed

- Click on the Details button to view a Detailed Listing of Fuel Tax Credit transactions relating to the current BAS period

Article ID CBP1181