Single Touch Payroll - Getting Started

- STP works by sending tax and super information from your STP-enabled payroll or accounting software to the ATO as you run your payroll. For more information on Single Touch Payroll click on the following ATO link What is STP?

- Cashbook will connect to the ATO through a Sending Service Provider (SSP).

- Practical Systems has picked SuperChoice to be the SSP, and as such you do not need to contact the ATO to set up a connection. You will need to register your business details with SuperChoice before you can submit Single Touch Payroll reports.

- This means you do not need an AUSkey to submit Single Touch Payroll information via Cashbook.

To Register Your Business Details with SuperChoice:

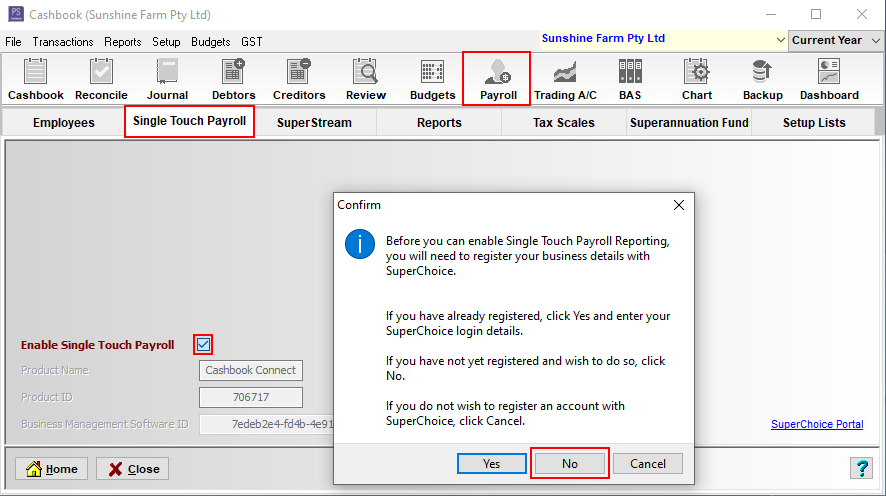

- Click on Payroll toolbar icon.

- Click on the Single Touch Payroll tab.

- Tick the Enable Single Touch Payroll check box.

- Click No button to the Confirm message, If you have not yet registered and wish to do so.

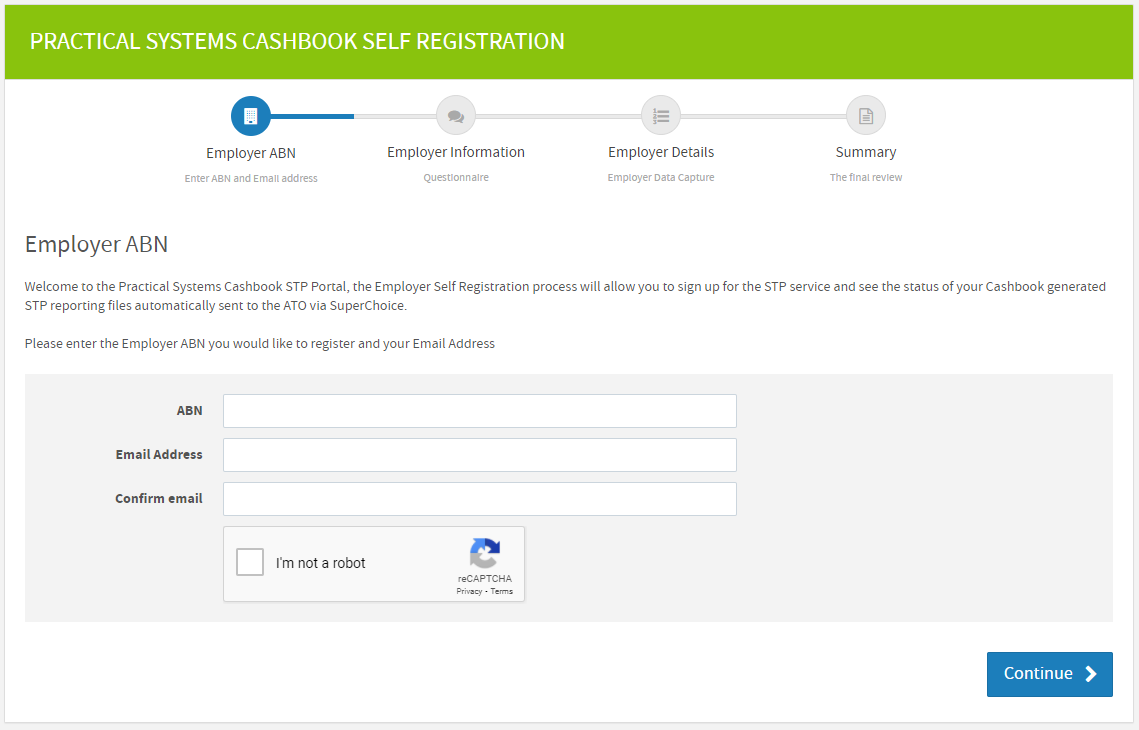

This will take you to the SuperChoice Portal. In the Employer ABN window:

- Enter your ABN

- Enter your email address

- Enter your email address again

- Tick I'm not a robot check box

- Click on the Continue button

- Follow the prompts and enter all information required.

- You will be asked to create a Username in the Summary section of this form - the final review window. This is unique to you and cannot be changed.

Note: If you have already registered your business details with SuperChoice and also wish to use SuperChoice as your clearing house for SuperStream, please contact us for assistance.

CSC Article ID 4364