GST-Free and Non-Reportable.

GST-Free and Non-Reportable

Non-reportable: (i.e. GST Category 10. Non-reportable Payments and 11. Non-reportable Receipts)

These GST categories are used for items that are excluded from the GST system and therefore not reported on the BAS in the GST section.

There are only minimal items which are not reportable for GST purposes. These include bank transfers between accounts, stamp duty, depreciation and salary/wages.

These GST categories are used for items that are excluded from the GST system and therefore not reported on the BAS in the GST section.

There are only minimal items which are not reportable for GST purposes. These include bank transfers between accounts, stamp duty, depreciation and salary/wages.

GST Free: (i.e. 03. GST Free Supplies, 04. Acquisitions with no GST, 07. Export Income (GST Free))

These are purchases/sales that have a 0% GST rate.

Examples include, purchasing items from overseas (exports); purchasing items from within Australia that are not subject to GST, eg. fresh food, some education.

GST free sale /expenses are reported on your BAS.

These are purchases/sales that have a 0% GST rate.

Examples include, purchasing items from overseas (exports); purchasing items from within Australia that are not subject to GST, eg. fresh food, some education.

GST free sale /expenses are reported on your BAS.

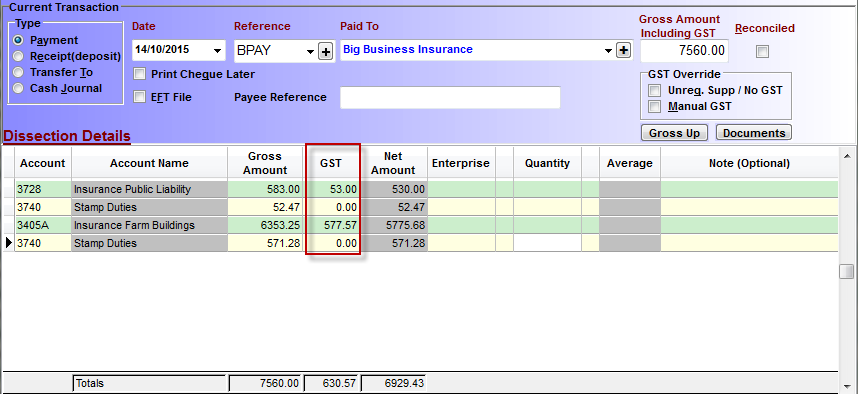

Note: Some invoices might have some items with GST and some without. If this is the case, you might have to split the invoice over two lines and use both an account attached to a GST category and one to a GST-Free category.

Note: Some invoices might have some items with GST and some without. If this is the case, you might have to split the invoice over two lines and use both an account attached to a GST category and one to a GST-Free category.For Example: Certain insurance may include stamp duty

Article ID 1388