Wages and Superannuation Accounts Setup

Wages & Superannuation Accounts Setup

Cashbook Platinum

This is a 6-step process:

- Set up a PAYG Liability account - the liability account to which will accrue the amounts withheld from the employee's pay that must be paid to the ATO

- Set up a Superannuation Liability account - the liability account to which will accrue the superannuation amounts that must be paid to nominated super funds

- Set up an Operating Expense account for wages payments

- Set up an Operating Expense account for superannuation payments

- Set up an Other Expense account for the PAYG withheld, linked to the PAYG liability account

- Set up an Other Expense account for superannuation withheld, linked to the superannuation liability account

Step 1: Set up a Liability (PAYG) Account

This account should already be set up in the Chart of Accounts. It would have been part of the "standard chart of accounts" selected as part of your original company setup

- Click Chart toolbar icon

- Click Liabilities tab

- Click on the account to highlight

- Click Edit (Click Add if you need to create this account and duplicate PAYG Withholding liability account chart setup below.)

The PAYG Withholding liability account should look like this:

Step 2: Set up a Liability (Superannuation) Account

This account should already be set up in the Chart of Accounts. It would have been part of the "standard chart of accounts" selected as part of your original company setup

- Click on the Chart toolbar icon

- Click on the Liabilities tab

- Click on the account to highlight

- Click Edit (Click Add if you need to create this account and duplicate Superannuation liability account chart setup below.)

The Superannuation liability account should look like this:

Step 3: Set up an Operating Expense Account for Salary / Wages Payments

Difference between salary and wages:

- Salaries Expense - Expenses incurred for the work performed by salaried employees during the accounting period. These employees normally receive a fixed amount on a weekly, monthly or annual basis. (i.e. a salaried person is paid a fixed amount per pay period.)

- Wages Expense - Expenses incurred for the work performed by non-salaried employees during the accounting period. These employees receive an hourly rate of pay. (i.e. a wage earner is paid by the hour.)

This account should already be set up in the Chart of Accounts. It would have been part of the "standard chart of accounts" selected as part of your original company setup, but you may wish to change this to suit your own company.

- Click on the Chart toolbar icon

- Click on the Expenses tab

- Scroll down to locate the wages accounts created in company setup

- Click on the account to highlight

- Click Edit (Click Add if you need to create this account and duplicate Wages account chart setup below.)

-

All wages expense accounts will have the same Chart setup:

- Account Type: Operating Expense

- GST Category: 10. Non-reportable Payments

- Reporting Group: 3-330 Labour

- Tick Wages Account checkbox

- Allocate Default Enterprise here if applicable

- Account Type: Operating Expense

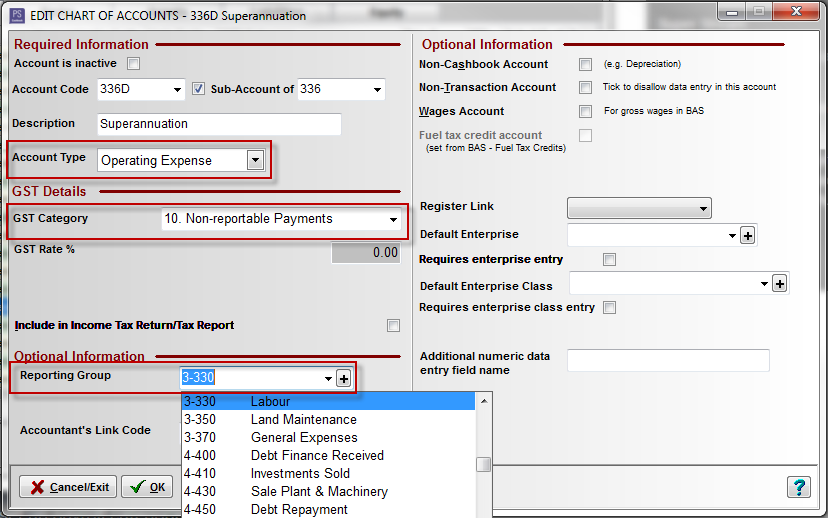

Step 4: Set up an Operating Expense Account for Superannuation Payments

This account should already be set up in the Chart of Accounts. It would have been part of the "standard chart of accounts" selected as part of your original company setup, but you may wish to change this to suit your own company.

- Click on the Chart toolbar icon

- Click on the Expenses tab

- Scroll down to locate the superannuation account created in company setup

- Click on the account to highlight

- Click Edit (Click Add if you need to create this account and duplicate Superannuation account chart setup below.)

-

All superannuation expense accounts will have the same chart setup:

- Account Type: Operating Expense

- GST Category: 10. Non-reportable Payments

- Reporting Group: 3-330 Labour

- Allocated Default Enterprise here if applicable.

- Account Type: Operating Expense

Step 5: Set up an Other Expense Account for PAYG Withheld, Linked to the PAYG Liability Account

This account should already be setup in the Chart of Accounts. It would have been part of the "standard chart of accounts" selected as part of your original company setup.

- Click on the Chart toolbar icon

- Click on the Expenses tab

- Scroll down to locate the PAYG Withholding Other Expense account created in company setup

- Click on the account to highlight

- Click Edit (Click Add if you need to create this account and duplicate PAYG withheld Other Expense account chart setup below.)

The PAYG Withholding other expense account should look like this:

Step 6: Set up an Other Expense Account for Superannuation Withheld, Linked to the Superannuation Liability Account

In most cases this account will have to be created

- Click on the Chart toolbar icon

- Click Add at the bottom of the window

-

Add the following account details:

- Account Code: SUPR

- Description: Superannuation Withheld

- Account Type: Other Expense

- GST Category: 10. Non-reportable Payments

- Reporting Group: 5-599 Taxation

-

Balance Sheet Link: 805 Superannuation Clearing Acc

Note: Balance Sheet Link - links other expense/income accounts to corresponding Balance Sheet account

Note: Balance Sheet Link - links other expense/income accounts to corresponding Balance Sheet account

- Account Code: SUPR

- Click OK to save

- Cashbook is now ready for an employee to be added to Payroll. Click the following link: Adding an Employee.

Article ID 1612