Set up Loan Accounts to Finance Asset Purchase

Cashbook Platinum

These are the steps for setting up the purchase of an asset via a new loan:

- Setup a Liability (Loan) account

- Setup an Other Income account

- Setup an Other Expense account

- These accounts will be used to show the income and expenses to and from the loan

- This income account will be used for withdrawing funds from the loan. Use this account to set the loan principal, and any time the amount owing needs to increase i.e. Interest etc.

- This expense account will be used for loan repayments or to reduce the amount owing on the loan

- These accounts will be used to show the income and expenses to and from the loan

- Setup an Asset account

- This Asset account is used for the purchase of the asset

- This Asset account is used for the purchase of the asset

- Setup an another Other Expense Account

- This expense account is used for the purchase of the asset. The purchase cost will be used to set the initial value of the asset. The value should include any GST and be before any trade-ins or deposits

- This expense account is used for the purchase of the asset. The purchase cost will be used to set the initial value of the asset. The value should include any GST and be before any trade-ins or deposits

- Setup an Interest account

- This expense account is used for the interest component paid on loans

- This expense account is used for the interest component paid on loans

- Add a Cashbook transaction to record the purchase of the asset via the loan

- Add a Cashbook transaction to record a loan repayment

For this example, we will set up accounts for the purchase of a John Deere tractor via a loan

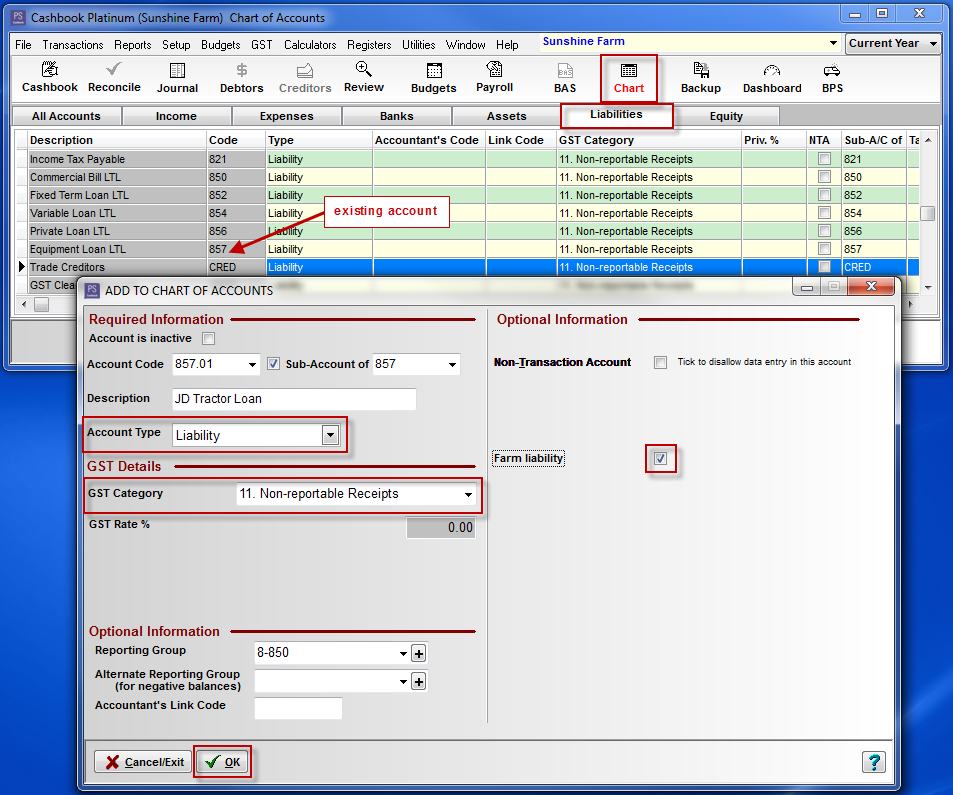

Step 1: Setup a Liability (Loan) account

- Click on the Chart toolbar icon

- Click on the Liabilities tab

- Cashbook Platinum comes with a standard chart of account classification. This can be added to or modified to suit the user's requirements. For this example, we have created a sub-account of an existing equipment account

- Click on the Add button

- Account Code: e.g. 857.01 Note: Sub-accounts must start with the same code as the main or control account

- If creating a new main account, keep the account code in the same number range as the other liability accounts. i.e. 800's

- Tick Sub-Account of check box

- Sub-Account of e.g. 857 Equipment Loan LTL

- Description: JD Tractor Loan

- Account Type: Liability

- GST Category: 11. Non-reportable Receipts

- Reporting Group: e.g. 8-850 Long Term Borrowings

- Tick Farm liability check box

- Account Code: e.g. 857.01 Note: Sub-accounts must start with the same code as the main or control account

- Click OK to save

For example:

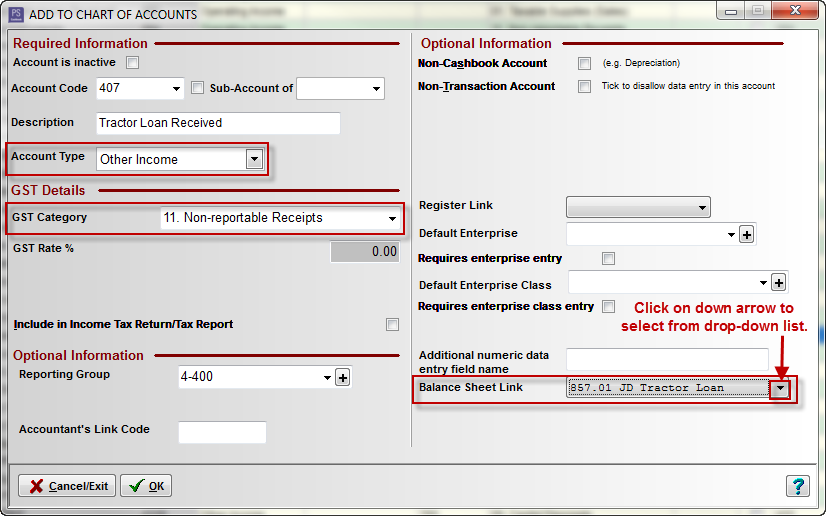

Step 2: Setup an Other Income Account

- Click Add

- Account Code: e.g. 407

- If creating a new main account, keep the account code in the same number range as the other, Other Income accounts. i.e. 400's. This could also be a sub-account of an existing type of loan received account already created in the Cashbook Chart. e.g. Fixed Loan Received

- Description: e.g. Tractor Loan Received

- Account Type: Other Income

- GST Category: 11. Non-reportable Receipts

- Reporting Group: 4-400 Debt Finance Received

- Balance Sheet Link: e.g. 857.01 JD Tractor Loan i.e. Liability account created in Step 1

- Account Code: e.g. 407

- Click OK to save

For example:

Step 3: Setup an Other Expense Account

- Click on the Expenses tab

- Scroll down to see if there is a loan repayment account applicable. Cashbook Platinum comes with a standard chart for account classification. This can be added to or modified to suit the user's requirements

- For this example, we have created a sub-account of an existing equipment loan repayments account

- Click Add

- Account Code: e.g. 457.01 Note: Sub-accounts must start with the same code as the main or control account

- If creating a new main account, keep the account code in the same number range as the other, Other Expense accounts. i.e. 400's.

- Tick Sub-Account of check box

- Sub-Account of e.g. 457 Equipment Loan Repayments

- Description: e.g. Tractor Loan Repayments

- Account Type: Other Expense

- GST Category: 10. Non-reportable Payments

- Reporting Group: e.g. 4-850 Debt Repayment

- Balance Sheet Link: 857.01 JD Tractor Loan (Liability account created in Step 1)

- Account Code: e.g. 457.01 Note: Sub-accounts must start with the same code as the main or control account

v. Click OK to save

For example:

Step 4: Setup an Asset Account

- Click on the Assets tab

- For this example we are purchasing a tractor. A tractor forms part of Plant & Equipment

- Note: Plant is immovable property or property that has been attached to the earth, whereas equipment (or machinery) is machines that can be moved on short notice

- Click on Plant & Equipment account to highlight

- Click Edit (or click on Add and fill in the following details)

- Your Asset account details should include:

- Account Code: 765 (Account Code numbering should be in the same number range as other Asset accounts. i.e. 700's.)

- Description: Plant & Equipment

- Account Type: Asset

- GST Category: 08. Capital Acquisitions

- Reporting Group: 7-750 Property, Plant & Equipment

- Tick Farm Asset check box

- Account Code: 765 (Account Code numbering should be in the same number range as other Asset accounts. i.e. 700's.)

- Click OK to save

For example:

Step 5: Setup Another Other Expense Account

- Click on the Expenses tab

- Scroll down to see if there is a plant & equipment purchases account. Cashbook Platinum comes with a standard chart for account classification. This can be added to or modified to suit the user's requirements

- Click on Plant & Equipment Purchases, sub-account Large Plant

- Click Edit

- This account should have the following Details:

- Account Code: e.g. 482A Note: Sub-accounts must start with the same code as the main or control account

- If creating a new main account, keep the account code in the same number range as the other, Other Expense accounts. i.e. 400's

- Tick Sub-Account of check box

- Sub-Account of e.g. 482 Plant & Equipment

- Description: e.g. Large Plant

- Account Type: Other Expense

- GST Category: 08. Capital Acquisitions

- Reporting Group: e.g. 4-480 Plant & Machinery Purchased

- From the Register Link dropdown menu, select Fixed Assets. This will provide direct access to the Fixed Asset register from data entry screens.

- Balance Sheet Link: 765 Plant & Equipment (Liability account created in Step 4)

- Click OK to save

- Account Code: e.g. 482A Note: Sub-accounts must start with the same code as the main or control account

- Click Close to exit Chart

For example:

Step 6: Setup an Interest Expense Account

Note: The principal is the amount borrowed and have to pay back, and interest is what the lender charges for lending the money

Note: The principal is the amount borrowed and have to pay back, and interest is what the lender charges for lending the money- Click on the Expenses tab

- Scroll down to see if there is an interest account applicable. (Cashbook Platinum comes with a standard chart for account classification. This can be added to or modified to suit the user's requirements.)

- For this example, we will be paying interest on the purchase a tractor

- Click Edit (or Add button, fill in details as follows.)

- Account Code: e.g. 320D Note: Sub-accounts must start with the same code as the main or control account.

- If creating a new main account, keep the account code in the same number range as the other, Other Expense accounts. i.e. 300's.

- Tick Sub-Account of check box

- Sub-Account of e.g. 320 Interest on Asset Purchase

- Description: e.g. Tractor

- Account Type: Operating Expense

- GST Category: 04. Acquistions with no GST

- Reporting Group: e.g. 3-320 Finance Expenses

- Account Code: e.g. 320D Note: Sub-accounts must start with the same code as the main or control account.

- Click OK to save

For example:

Step 7: Cashbook Entry to Record Purchase of Asset via a Loan and Add Asset to Fixed Asset Register

- Click on Cashbook toolbar option

- Click Add

- The transaction Type is Cash Journal

For example:

iv. Click on the F button to enter the Fixed Asset Registerv. Click Addvi. Enter new asset details

- Note:

- Click on the New Asset radio dial

- Original Cost - net of any GST

- Purchased From - select from drop-down list of suppliers or enter new name

- Value for depreciation - this will normally be the same as the cost of the asset

- Date for depreciation - i.e. date from which depreciation is calculated - this will normally be the same as the purchase date

- Depreciation Details - Depreciation Details such as (Depreciation) Rate%, Private Use% and Method of Depreciation - Diminishing Value and Prime Cost. - these should be entered after advice from your accountant

- Click on the New Asset radio dial

vii. Click OK to save details to Fixed Asset Registerviii. Click OK to save the Cashbook transaction

- Note: There are two methods you can use to calculate asset depreciation

- Prime Cost - used to depreciated assets by equal amounts each year over its effective life

- Diminishing Value - uses a percentage to calculate depreciation i.e. the value of a depreciating asset decreases more it the early years of its effective life

Click on the following ATO website link: Prime cost and diminishing value methods for further information.

Note: It is strongly advised you contact your accountant for help in calculating depreciation amounts and which method you should use. Your accountant can look at how your business operates to determine which method is appropriate. Also consult your accountant as to when to depreciate your assets, e.g. at the end of the financial year.

Note: It is strongly advised you contact your accountant for help in calculating depreciation amounts and which method you should use. Your accountant can look at how your business operates to determine which method is appropriate. Also consult your accountant as to when to depreciate your assets, e.g. at the end of the financial year. Note: The sections coloured Red must have information entered in them. The other sections are optional

For example:

Step 8: Cashbook Entry to Record a Loan Repayment

- Click on Cashbook toolbar option

- Click Add

- The transaction Type is Payment

For example: Recording a loan payment which contains both interest and principal payments

The credit balance of your liability account (e.g. 857.01 JD tractor Loan) should agree with the loan balance shown on the loan statement furnished by your lender. If such a statement is not provided, you can phone your lender and ask for the principal balance on your loan.

To view the balance of your liability account/s at a given date, look at your Trial Balance:

- Click on Reports

- Accounting Detail

- Trial balance menu option

- Select the Report as at date

- Click on the Print button

- Scroll down to the Liabilities section of the Trial Balance

- See credit balance of your loan