Superannuation Owing

PS Cashbook

Superannuation Owing

Summary

I have chosen to add my Payroll entries to Cashbook but when I try to choose an account for the Super Owing option in Payroll it is not available in the list. What do I need to do?

What else do I need to do to ensure superannuation contributions are accounted for properly?

Detailed Description

Step 1

- Click on the Chart toolbar option.

Step 2

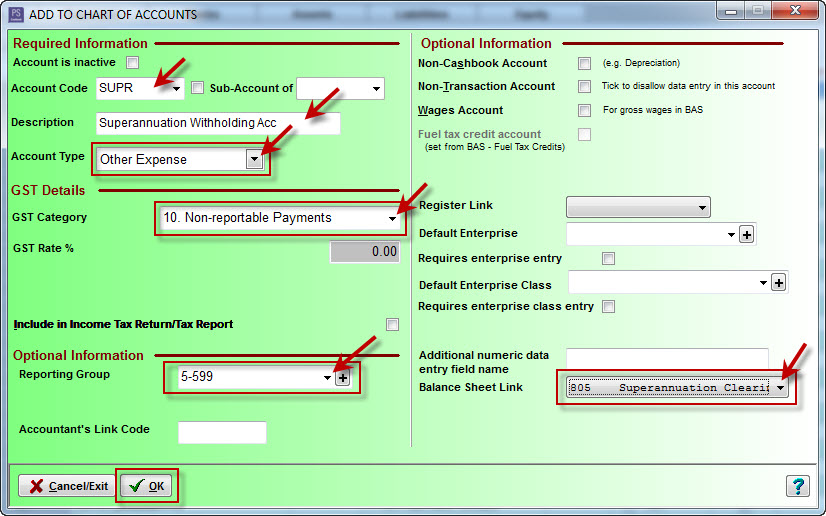

- Click on the Add button.

- Fill out information as follows:

- The Balance Sheet Link allows non-operating income and expense accounts to be linked to a corresponding Asset, Liability or Equity account.

(ie. Superannuation Withholding Account (Other Expense) links to the Superannuation Clearing Account (Liability).

Entries to these accounts will show on Cashflow reports and Balance Sheet reports but not the Profit and Loss reports. - Click on the OK button.

Step 3

- Make sure all Wages accounts being used in Payroll have the Wages Account ticked.

- Click on Chart toolbar option.

- Enter account code in the Search For Code box.

- Click on Edit button.

- In Option Informational section, tick Wages Account box.

- Click on the OK button.

Step 4

- Click on the Payroll toolbar option.

- Click on the Employees tab.

- Click on the Add Employee button. (or Select Employee).

- Fill in all employee information.

- Tick the Add Pay Transactions to Cashbook.

- Add a Wages account (Permanent and Casual employees are usually a different account code).

- Add a Superannuation expense account.

- Add the Superannuation owing account you have created above.

Step 5

- Click on the Tax and Super tab.

- Enter all employee information.

- Crucial information includes the Tax Scale (select from the drop down menu),

Tax File Number (if you have not included a date of birth for this particular employee), Employer Super Rate % (eg. 9.5). - Click OK button.

Step 6

- Fill in all Applicable Pay Rates information.

- Standard Pay: choose Pay Frequency (eg. Weekly, Fortnightly, etc.) and Pay By (eg. Cheque, Cash, Bank, etc.).

- Wages/Salary: Add a new Wages/Salary Item. Make sure the Super and Taxable boxes are ticked. Also, the include with wages is highlighted.)

- Allowances: if any.

- Deductions: if any.

- Click on the OK button.