Year-end allocation of profit or loss to owners equity accounts.

Year-End Allocation of Profit or Loss to Owners Equity Accounts

Cashbook provides a simple method of automatically allocating year-end profit or loss to owners equity accounts in any nominated proportion. Distributions can be on a percentage basis (e.g. partnerships) and/or a fixed dollar entitlement (e.g. partner salaries, trust distributions, etc.)

To Setup Profit Distribution

Step 1: Equity

- Ensure that you have set up all required profit distribution accounts in the Equity section of the chart of accounts.

- Click the Chart toolbar option

- Click the Equity tab

- Click Add, if you need to create an account

Below is an example of how Equity accounts may appear for a partnership:

- Account Code: keep code in the same number range as other equity accounts e.g. 800's

- Description: e.g. Share of Profits - John Smith. For a company, this account may be simply called - 850 Current Year Profit and Loss

- Account Type: Equity

- GST Category: 11. Non-reportable Receipts

- Balance Forward A/C: Linked to header account e.g. 850 Opening Balance - JS. For a company, the link will be the same account code, 850 Current Year Profit and Loss

Note: A separate equity account must be set up for each name (partner)

Note: A separate equity account must be set up for each name (partner)

Example of equity account required for profit distribution:

Step 2: Profit and Loss

Run a profit and loss statement for the period required (usually full financial year). This can be printed to screen.

- For Cashbook Connect:

- Click Reports

- Financials

- Profit and Loss menu option

- Select Date Range: To select, click on the first month of the financial year, hold down the Shift key and then click on the last month on the financial year, all month options should be highlighted blue

- Report Type: Accrual

- Tick check box for applicable options, e.g Print account code, Year-to-date Only

- Apply any filters on the Account Filters tab

- Click Print

- Scroll down to see the Profit and Loss amount

- For Cashbook Platinum:

- Click Reports

- Management Financials menu option

- Select the Profit & Loss option

- Report Period - highlight the whole of the financial year. To select, click on the first month of the financial year, hold down the Shift key and then click on the last month on the financial year, all month options should be highlighted blue

- Report Level: Account

- Include Columns: tick Selected period - this year

- Report Format: Standard

- Accounting Method: Accrual

- Stock Valuation - Accounting/Tax

- Report Basis - Accounting/Tax

- Click Print

- Scroll down to see the Profit and Loss amount

For example:

Step 3: Profit Distributions

- Click Setup

- Profit Distributions menu option

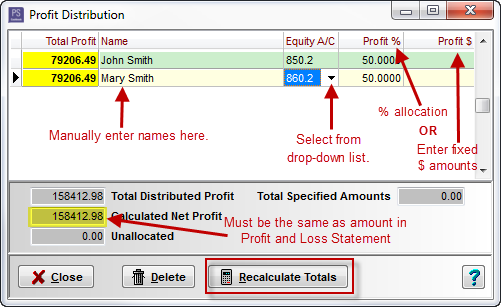

- Enter in the names of the equity accounts required e.g. names of partners, beneficiaries, etc. Each name is attached to an equity account in the chart of accounts (select from the drop down list) and can have a % share or fixed dollar share of profit (or both). The program will distribute the fixed dollar amounts first and then any % entitlement after that

- Click Recalculate Totals to distribute the profit

These amounts will now display in the equity section of the assets & liabilities report and the profit & loss statement. Remember to click the include "profit distribution" checkbox

To delete a name from the profit distribution list, highlight the name and click the Delete button and then Yes to confirm

Note: The Profit Distributions options is not available on all levels of Cashbook

Article ID 1669